For decades, dual-use lived in policy documents and export-control lists; a technical label for technologies that could serve both civilian and military needs. Born in the nuclear era, expanded through aerospace, and later stapled onto “sensitive but versatile tech.”

But the world has shifted.

Today, dual-use is no longer a regulatory classification; it’s a core business strategy.

Until recently, dual-use meant optionality. A startup might say:

“Our AI platform could be adapted for defense use.”

That logic has flipped.

Commercial innovation — especially in autonomy, sensors, materials, power systems, and robotics — is now outpacing military R&D. Governments and investors can’t ignore it. Founders can’t afford to treat defense as a side path. Ministries of “defense” are rebranding themselves as ministries of security, resilience, and warfare. Corporations that once identified as “aerospace,” “analytics,” or “hardware” now describe their mission as delivering national security solutions.

The language is shifting because the stakes have.

The concentration problem, and the opportunity it creates

Defense remains dominated by a small cluster of legacy primes. Recent data shows:

- 7 of the 11 largest U.S. defense contracts were awarded to Lockheed Martin, Boeing, Northrop Grumman, RTX, and General Dynamics.

- Together, the top five captured ~$770B in Pentagon funding from 2020–2024 — roughly one-third of total contract value.

This concentration creates two opposite forces:

- Security for Incumbents

Stable contracts. Long cycles. Deep integration. Slow movement.

- Open Lanes for Small Teams

Fast validation. Rapid integration.

And a new path to win: proof in the field, not proof in the boardroom. DIU reports that 68% of its 2024 OTAs (Other Transaction Authorities) went to small or non-traditional vendors. The future won’t be defined by decade-long procurements but by rapid-execution partnerships.

Why This Matters for Investors

For years, venture capital avoided defense. Too slow. Too political. Too disconnected from scalable markets. That perception is dead.

Today, dual-use isn’t about militarizing startups, it’s about commercializing defense.

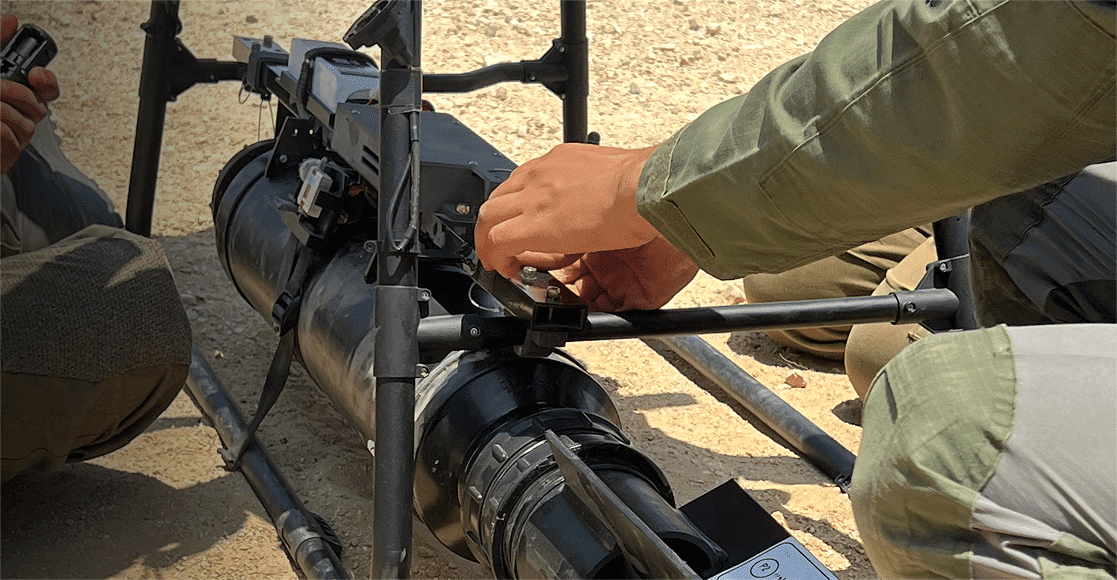

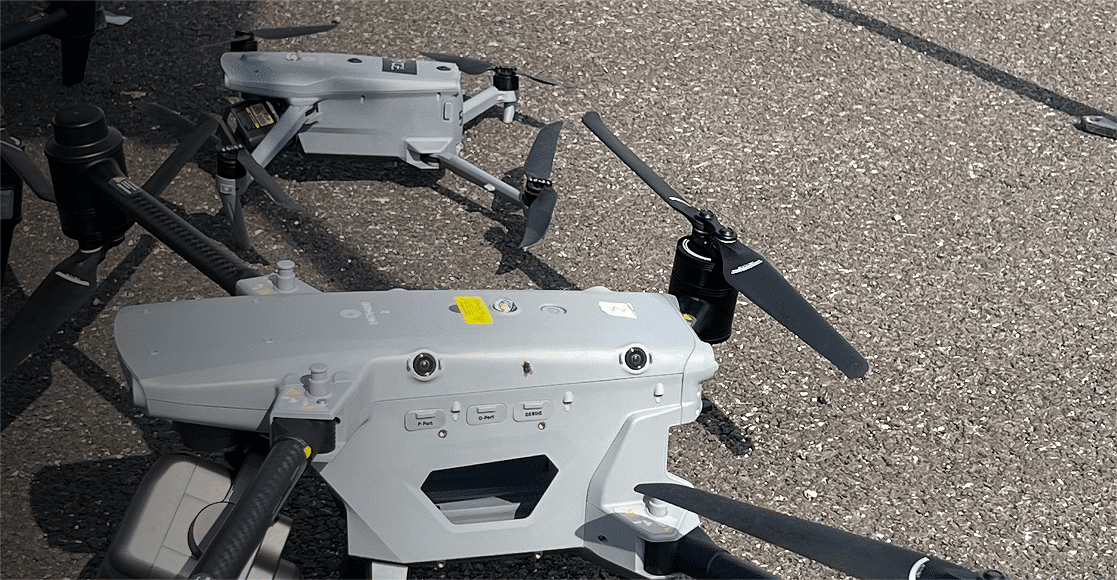

- The autonomy stack powering a delivery drone can secure a border.

- A materials breakthrough in EV batteries becomes next-gen propulsion.

- A robotics platform built for warehouses becomes a frontline logistics enabler.

Kela Technologies

AMICELL – AMIT INDUSTRIES LTD

Roboteam

For investors, that means:

- Shorter paths to government validation

- Bigger TAM across civilian + defense markets

- A strategic hedge in a more volatile, multipolar world

Defense has become a place where capital can both scale and matter

The Era of Quick Wins and Narrow Windows

It took Anduril Industries moving the Barracuda-500 drone from concept to a production-intent phase in about one year, compared to the MQ-9 Reaper that took at least five years. We are entering a period where small startups can win fast, but only if they deliver operational credibility:

- Reliability

- Compliance

- Survivability

- Actual mission-fit

The gap between prototype and program is collapsing. The edge belongs to teams that can integrate:

⚙️ Hardware

🧠 Autonomy

🎯 Mission requirements

⚡ At startup speed

This is the gap UAX focuses on, helping founders turn innovation into deployment and helping investors understand where autonomy becomes advantage.

Final Word

Dual-use is no longer a compliance term. It is an investment roadmap for the next industrial era. Where autonomy, defense, and venture finally converge.

Whether you’re a founder or an investor, this is the moment to pay attention. Because the next generation of defense leadership will not be built by giants alone.